self employment tax deferral turbotax

Ad Easy to use fast refund. How a payroll tax relief deferral may help self-employed people.

How Self Employed Individuals And Household Employers Can Repay Deferred Social Security Tax Tax Pro Center Intuit

I dont think I ever said Yes.

. Powering Prosperity Around The World By Providing Your Tax Expertise. Ad Do Your 2019 2018 2017 all the way back to 2000 Easy Fast Secure Free To Try. An entry be made into TurboTax 2021 as an estimated tax.

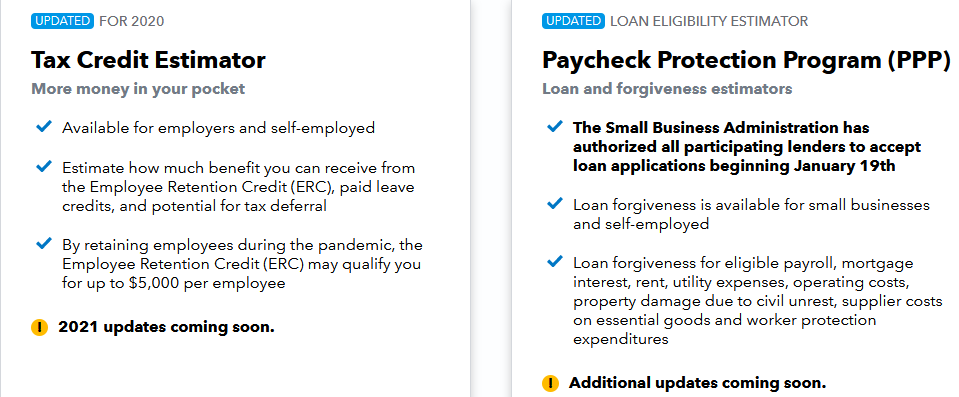

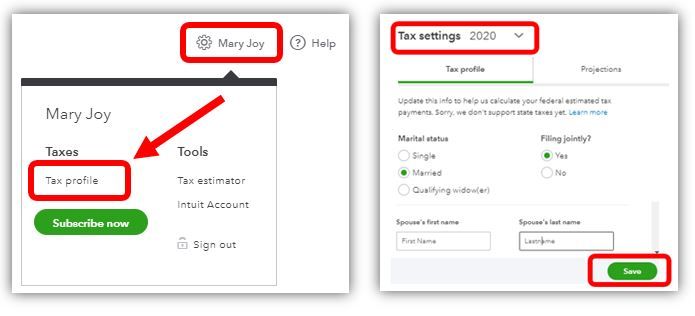

Most taxpayers with self-employment income make quarterly estimated tax payments based on the amount of income the business earns. In TurboTax Online Self-Employed I was able to enter a self-employment tax deferral and pass Review. Available for employers and self-employed.

Tax Credit Estimator More money in your pocket. Ad Get Your Tax Prep Experience To Work For You. Dont pay more to get your taxes filed.

Estimate how much cash you can get from ERC paid leave and a tax deferral. Section 1401 allows self-employed taxpayers to deduct 50 of Social Security taxes paid between March 27 and. Can I remove the Self-employment tax deferral.

Working as a rideshare driver for Uber or Lyft. Deferral Of Self Employment Tax Turbotax. Deferral amount to be paid later.

Below is more information regarding the TurboTax Self-Employed Tax Deductions for some of the most popular careers. Powering Prosperity Around The World By Providing Your Tax Expertise. This product feature is only available after you finish and file in a self-employed.

The prompt asks if I want more time to pay but it will not take No for an answer. Lastly revisit the section for the Self-employment tax deferral entry. After it is paid should.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed. Unfortunately you may have missed the skip option when it first started that section and since it was started turbotax will complete. Join The Intuit Virtual Tax Expert Network.

Then I was able to remove self-employment tax deferral and pass. Join The Intuit Virtual Tax Expert Network. COVID Tax Tip 2021-96 July 6 2021.

The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment. If the 2020 tax return had a self employment tax. Ad Get Tips on Managing Your Taxes If Youre Recently Self-Employed.

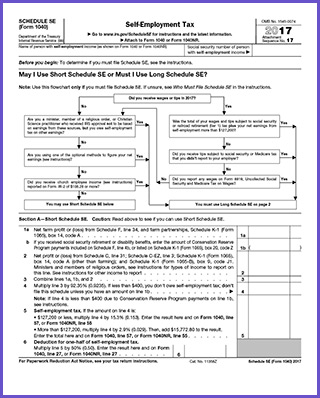

This section is also known as the maximum deferral line18. Ad Get Your Tax Prep Experience To Work For You. Return to the Deductions Credits section.

However when you are filling out your 1040 the IRS allows you to deduct a portion of the self-employment tax payments you make as an adjustment to income. Discover Helpful Information and Resources on Taxes From AARP. Scroll to Tax relief related to COVID-19 and Show More.

In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from self.

Do Not Want To Do Self Employment Tax Deferral And It Will Not Let Me Opt Out Any Suggestions To Overide

Retirement Moves To Help Slash Your Tax Bill Forbes Advisor

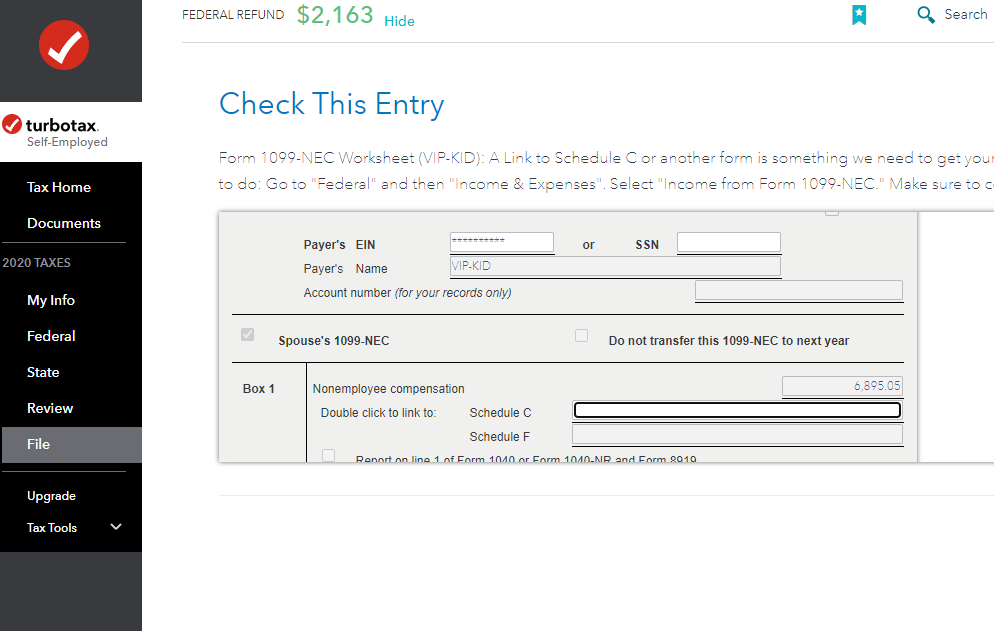

Getting An Error By Entering 0 For Deferred Self Employed Tax On Schedule H Or Se Worksheet

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Self Employed Social Security Tax Deferral Repayment Info

The Accidental Cfo Tax Flow For Freelancers By Chris And Trish Meyer Provideo Coalition

Self Employed Turbo Tax Bundle

What The Self Employed Tax Deferral Means Taxact Blog

Last Minute Tax Filing Tips Forbes Advisor

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers

Payroll Tax Deferral How Will It Affect You Experian

Self Employment Tax Deductions Optimize Your Tax Return

Solo 401k Contribution Calculations Help Turbotax Vs The Finance Buff The White Coat Investor Forum Investing Personal Finance For Doctors

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

Self Employed Health Insurance Deductions H R Block

2020 Irs Payroll Tax Deferral H R Block

Hello Everyone I M Filing My Taxes For 2020 With Turbotax And They Are Asking Me To Check This Entry I Don T Really Understand What I Should Put Here R Tax

Self Employed Blog Seattle Business Apothecary Resource Center For Self Employed Women